Your 2025-2026 Benefits

Medical Benefits

Eligibility

In 2025-2026, all public-school employees who work on average a minimum of 17.5 hours per week during the school year or calendar year shall have the right to enroll in a health benefit plan with an employer subsidy to pay for premium and out-of-pocket (OOP) costs. Employees may elect coverage for themselves, their spouses, domestic partners and other qualified dependents from any of the four (4) tiers (e.g., single, two-person, parent/child[ren] and family) in any of the four (4) plans (e.g., Platinum, Gold, Gold CDHP or Silver CDHP) offered by VEHI. Spouses of employees shall include those by marriage, domestic partnerships, or civil unions.

Summary of Benefits and Coverages

WSESU is pleased to offer their employees health insurance in collaboration with the Vermont Education Health Initiative (VEHI) through BCBSVT in 2025-2026.

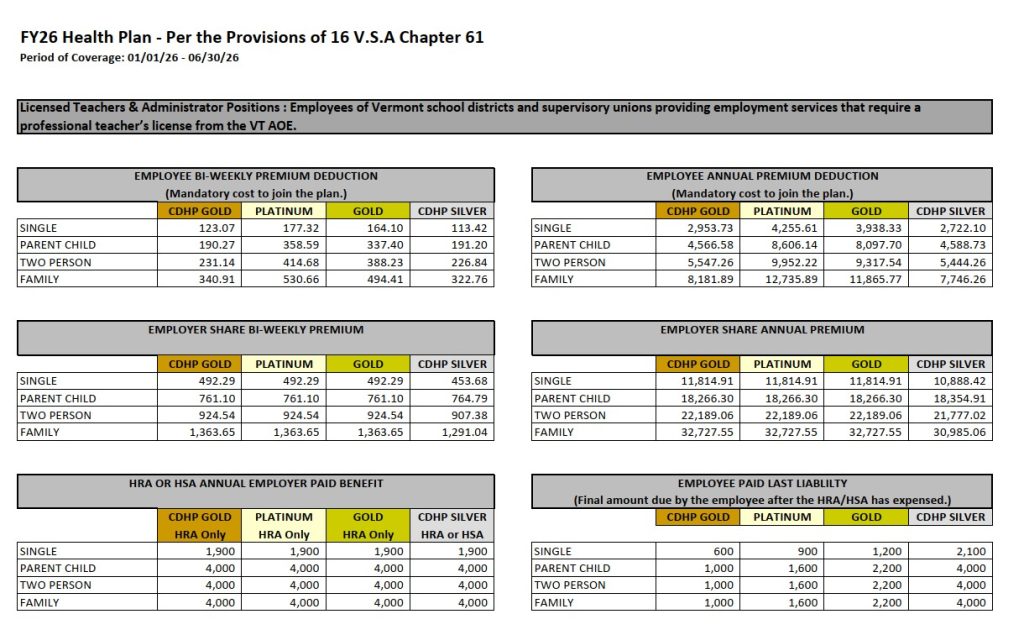

Below is the Plan & Cost Comparison chart for Licensed Employees:

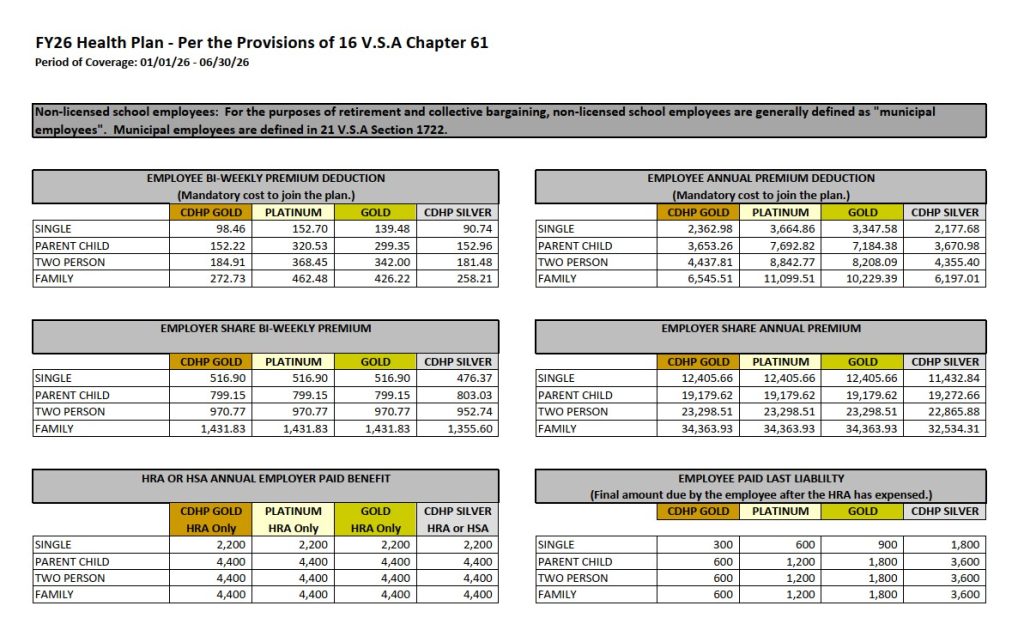

And below is the Plan & Cost Comparison chart for Non-Licensed Employees:

Employee Cost – Licensed Employees 01/01/26 to 06/30/26

Employee Cost – Non-Licensed Employees 01/01/26 to 06/30/26

Carrier Contact Information

BlueCross BlueShield of VT: Medical Insurance

Customer Service: 800-247-2583

Website: www.bcbsvt.com

Documents: For 2025 & 2026

Additional Information

Telehealth Benefits

Employees enrolled in any of the BlueCross BlueShield of VT medical plans have access to telehealth services offered through Amwell via phone or video conference, you can consult with a board certified physician to obtain convenient care for minor conditions/symptoms. You are encouraged to register now, so you can avoid this process in the future when circumstances cause to to obtain a consult. Any payments for these services are automatically applied to the out-of-pocket maximum under your plan.

Help Center Contact Information

Health Savings Accounts

Health Savings Accounts (HSA)

A Health Savings Account (HSA) is a tax-advantaged savings account owned by an individual that can be used to pay for qualified medical expenses for the account owner and their dependents. An HSA, which must be paired with an HSA-qualified health plan (like the WSESU sponsored Silver CDHP medical plan), allows employees and employers to make pre-tax contributions to a federally-insured account. All of the money in an HSA (including employer contributions) is owned by the employee even if they leave their job, lose their coverage or retire. The money in an HSA never expires and all funds roll over each year.

2026

- WSESU/ WSESD/ VTSD will contribute $1,900 Single/ $4,000 2-Person or Family to a licensed employee’s HSA in 2026.

- WSESU/ WSESD/ VTSD will contribute $2,200 Single/ $4,400 2-Person or Family to a non- licensed employee’s HSA in 2026.

In addition, you can contribute your own money to cover any remaining out of pocket expenses.

2026 Maximum Contributions:

- $4,400 for single coverage

- $8,750 for two-person or family coverage

- A catch-up contribution of $1,000 can be made if over the age of 55.

Distributions from the HSA are tax-exempt if used for qualified expenses. Distributions made for other than qualified medical expenses are subject to income tax and a 20% penalty. Anyone covered by another health insurance plan (Medicare, spouse’s policy) is not eligible for an HSA.

HSA Eligibility

To be eligible for an HSA, an employee must:

- Be enrolled in a qualified HDHP (ie: WSESU’s Silver CDHP Plan)

- Not be claimed as a dependent on another’s tax return

- Not be enrolled in Medicare

- Not be insured under any other medical plan that is not an HDHP

HSA Forms & Information

If you are enrolling in an HSA with WSESU, you will need to complete the HSA form found below and return to HR before any HSA contributions can be made to you and your HSA account.

Carrier Contact Information

HealthEquity

Phone number – 1.866.346.5800 (24/7/365 support)

Health Reimbursement Accounts, Dependent Care Accounts & Flexible Spending Accounts

Health Reimbursement Account (HRA)

A Health Reimbursement Account (HRA) is a funding arrangement provided to help offset expenses associated with an IRS qualified high deductible health plan (HDHP). All plans offered by WSESU are qualified plans. But please note, if you are enrolled in the Silver CDHP plan, you have the option of enrolling in the HRA or HSA plan.

2026

- WSESU/ WSESD/ VTSD will contribute $1,900 Single/ $4,000 2-Person or Family to a licensed employee’s HSA.

- WSESU/ WSESD/ VTSD will contribute $2,200 Single/ $4,400 2-Person or Family to a non- licensed employee’s HSA.

These amounts can be used towards your out of pocket medical and prescription expenses and are 100% employer funded.

The HRA is administered by Health Equity in conjunction with BCBSVT and will automatically be established for you if you enroll in the any of the medical plans offered by WSESU unless you have opted to enroll in the HSA and are enrolled in the Silver CDHP plan.

Dependent Care Account (DCFSA)

The Dependent Care Account allows employees to use pre-tax dollars toward qualified dependent care such as caring for children under age 13 or elder care. In 2026, the annual maximum amount you may contribute to the Dependent Care Account is $7,500 (or $3,750 if married and filing separately) per calendar year. To enroll in this account, you will need to elect it annually during the Open Enrollment period or if you have a qualifying life event.

Flexible Spending Account (FSA)

The Flexible Spending Account (FSA) allows employees who do not have a Health Savings Account (HSA) the opportunity to set aside pre-tax dollars for unreimbursed medical, dental, vision or other health related expenses. In 2026, the maximum amount an employee can contribute to an FSA is $3,400. This plan includes a rollover provision that allows employees enrolled in an FSA to rollover up to $680 of unused 2026 funds into the next plan year. To enroll in this account, you will need to elect it annually during the Open Enrollment period or if you have a qualifying life event. WSESU also requires a minimum annual election of $300 to enroll.

Limited Purpose Flexible Spending Account (FSA)

The Limited Purpose Flexible Spending Account (LPFSA) allows employees who also have a Health Savings Account (HSA) the opportunity to set aside pre-tax dollars for unreimbursed dental and vision expenses. Please note: this account does not provide reimbursements for medical expenses. In 2026, the maximum an employee can contribute to and LPFSA is $3,400. This plan includes a rollover provision that allows employees enrolled in an LPFSA to rollover up to $680 of unused 2026 funds into the next plan year. To enroll in this account, you will need to elect it annually during the Open Enrollment period or if you have a qualifying life event. WSESU also requires a minimum annual election of $300 to enroll.

Carrier Contact Information

Forms & Links

Health Reimbursement Account (HRA)

Flexible Spending Account (FSA)

Dependent Care Account (DCA)

Additional Forms & Links

Dental Benefits

Eligiblity

All public school employees who work on average a minimum of 17.5 hours per week during the school year or calendar year are eligible to enroll in the dental benefits offered by WSESU.

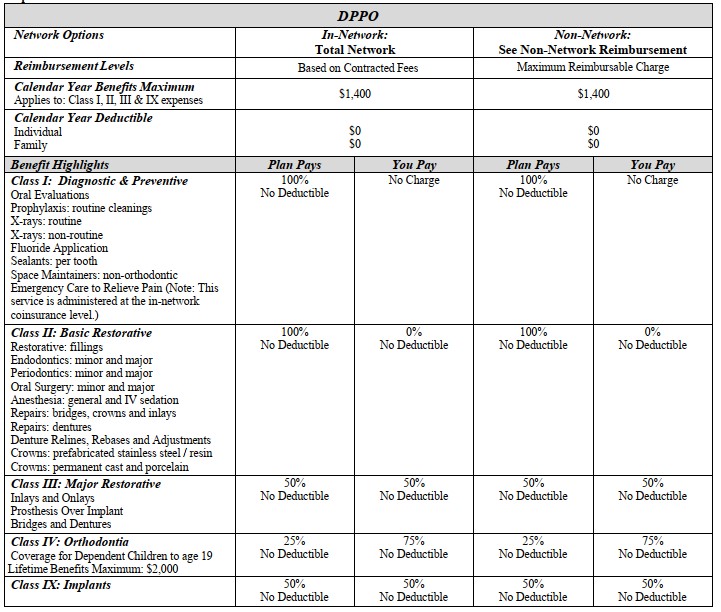

Summary of Benefits and Coverages

Below is a summary of services:

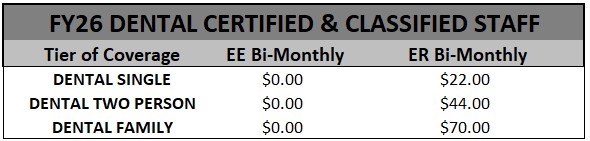

Contributions & Rates

Carrier Contact Information

Cigna: Dental Insurance

Customer Service: 1-800-244-6224

Website: www.mycigna.com

How to Access Digital ID Cards

Forms and Plan Documents

Forms

Additional Information

Domestic Partners

Support Staff and Teachers who have same- or opposite-sex qualified domestic partners meeting the criteria outlined below may enroll one such partner under their selected health and dental insurance plans (subject to Act 11 of 2018 and the Health Commission’s Resolution effective 1/1/2023). Coverage will be provided at the insurance rate determined by the health insurance carrier for changes in the employee’s coverage. The Association agrees to indemnify the Board against any related legal claims, expenses, or fees, and any tax implications from this coverage will be the employee’s responsibility.

Policies

Basic Life and AD&D Insurance

Eligibility

All active Union and Non-Union employees regularly working a minimum of 17.5 hours per week are eligible on the first of the month coinciding with or following date of hire.

Summary of Benefits and Coverages

WSESU provides benefit-eligible employees with the core benefits of life insurance and accidental death & dismemberment insurance. Please click on the button of the class you belong to below for further information on your Life and AD&D benefits:

Please note: If you are in Class 4 for Group Life, you are part of Class 3 for Group AD&D.

Carrier Contact Information

National Insurance Services: Life and AD&D Insurance

Customer Service: 1-800-627-3660

Website: https://www.nisbenefits.com/

Contributions

Basic Life & AD&D is 100% paid for by WSESU.

Forms & Plan Documents

Long-Term Disability Insurance

Eligibility

All active Union and Non-Union employees regularly working a minimum of 17.5 hours per week are eligible on the first of the month coinciding with or following date of hire.

Summary of Benefits and Coverages

Long-Term Disability Insurance:

- 100% funded by the employer.

- Benefit is 66 2/3% of basic monthly earnings up to a $6,000 maximum.

- Payment of benefits begin after 60 days from the start of a qualified disability.

Carrier Contact Information

National Insurance Services: Long Term Disability Insurance

Customer Service: 1-800-627-3660

Website: https://www.nisbenefits.com/

Plan Forms and Documents

Employee Assistance Program (EAP)

Eligibility

The EAP is open to all employees of WSESU.

Summary of EAP

- Invest EAP offers a number of confidential short term counseling services for mental health, eldercare, parenting techniques and much much more! It is free for all employees and their household members.

- When you call, your call goes to the Invest EAP counselor nearest you. If your local counselor is busy, you can choose to leave a voicemail. If you prefer to speak with someone right away, follow the prompts to speak with a live counselor.

- Find videos, articles, self-assessments and more!

- To register, please contact Human Resources for the organization password.

Carrier Contact Information

Employee Assistance Program (EAP): InvestEAP

Customer Service Toll-Free: 1-800-287-2173

Website: www.investeap.org

Retirement Plan

Summary of Retirement Plans

Vermont State Teachers’ Retirement System (VSTRS)

The Vermont State Teachers’ Retirement System (VSTRS) is the public pension plan provided by the State of Vermont for State teachers. It was created in 1947 and is governed by Vermont Statute Title 16, Chapter 55.Please visit the VSTRS website for additional information.

Vermont Municipal Employee Retirement System (VMERS)

Vermont Municipal Employees’ Retirement System (VMERS) is the public pension plan provided by the State of Vermont for participating municipalities’ employees. It was created in 1975 and is governed by Vermont Statute Title 24, Chapter 125.Employees hired after July 1, 2007 that are covered under a Support Staff Agreement have mandatory participation in VMERS, Group A. All employees who work at least 1040 hours per year are required to participate. One’s participation in the retirement plan forms a foundation for retirement income at a later time in life. The plan works by members and the school district making contributions to the fund; the funds are invested and interest earnings are placed in reserve to pay benefits to retired members. Members will make a pre-tax contribution based on their annual salary in the amount set forth by the Office of the Vermont State Treasurer as follows:

For more information on group plans, including the Defined Contribution and the Deferred Compensation plans, please see the VMERS web page.

403b Plan

All employers within the Windham Southeast Supervisory Union, each offer a 403(b) Tax Sheltered Account Plan to employees. As an eligible employee you have the ability to participate in the Plan by making voluntary salary reduction contributions to the Plan. For information and forms for setting up a 403(b) account, please visit tsacg.com and review the 403b Plan Instructions form on this page.